Tax Time: Be Glad Your Not Mark Zuckerberg!

It’s the time of year most everyone hates with a passion: Tax Day! But considering the nasty tax bill that Facebook founder Mark Zuckerberg is looking at make any other millionaire jump for joy. Not only will Zuckerberg hold the record for the largest tax bill ever paid but I believe he would also be the youngest to do so.

Mark Zuckerberg is actually planning on exercising $5 billion worth of stock options in 2012 when his accountants informed him his tax bill could be close to $2 billion! In 2009, the 400 wealthiest filers averaged $48 million in federal income taxes but Zuckerberg is looking at a tax bill in the millions.

As for Warren Buffett with his 17% tax rate? He paid less than $7 million in federal income and payroll taxes in 2010. Surely a $3 billion after-tax take-home is nothing to complain about, right?

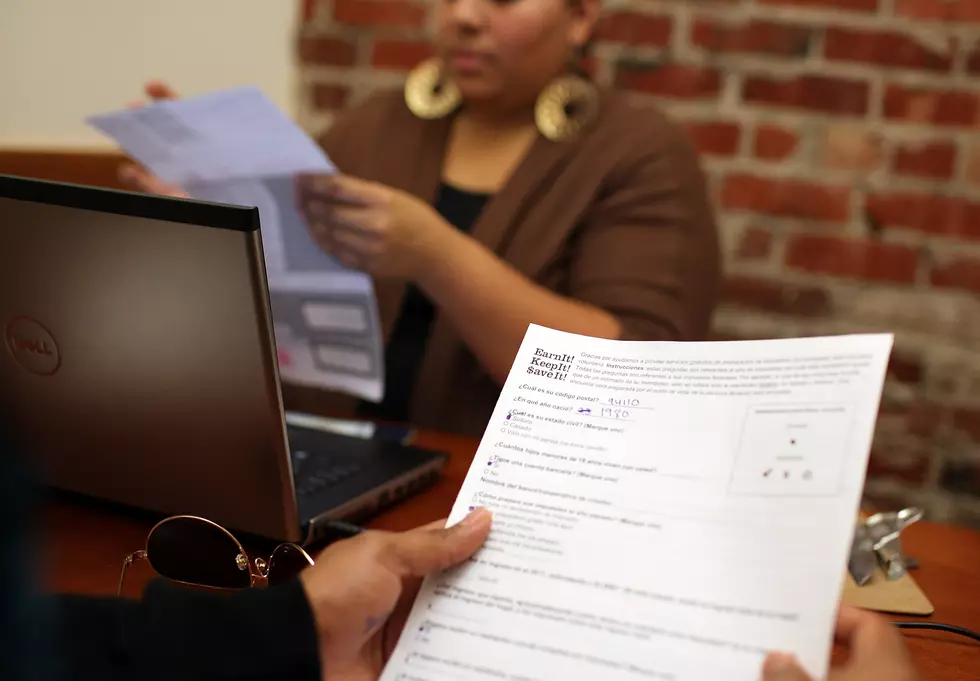

For the rest of us who live in the real world, paycheck to paycheck, here are some helpful hints directly from the IRS that may help you this year or in years to come.

- Start gathering your records Round up any documents or forms you’ll need when filing your taxes: receipts, canceled checks and other documents that support income or deductions you’re claiming on your return.

- Be on the lookout W-2s and 1099s will be coming soon; you’ll need these to file your tax return.

- Use Free File Let Free File do the hard work for you with brand-name tax software or online fillable forms. It’s available exclusively on the IRS website. Everyone can find an option to prepare their tax return and e-file it for free. If you made $58,000 or less, you qualify for free tax software that is offered through a private-public partnership with manufacturers. If you made more or are comfortable preparing your own tax return, there’s Free File Fillable Forms, the electronic versions of IRS paper forms.

- Try IRS e-file After 21 years, IRS e-file has become the safe, easy and most common way to file a tax return. Last year, 70 percent of taxpayers – 99 million people – used IRS e-file. Starting in 2011, many tax preparers will be required to use e-file and will explain your filing options to you. This is your chance to give it a try. IRS e-file is approaching 1 billion returns processed safely and securely. If you owe taxes, you have payment options to file immediately and pay by the tax deadline. Best of all, combine e-file with direct deposit and you get your refund in as few as 10 days.

- Consider other filing options There are many different options for filing your tax return.You can prepare it yourself or go to a tax preparer. You may be eligible for free face-to-face help at an IRS office or volunteer site. Give yourself time to weigh all the different options and find the one that best suits your needs.

- Consider Direct Deposit If you elect to have your refund directly deposited into your bank account, you’ll receive it faster than waiting for a paper check.

- Visit the IRS website again and again The official IRS website is a great place to find everything you’ll need to file your tax return: forms, publications, tips, answers to frequently asked questions and updates on tax law changes.

- Remember this number: 17 Check out IRS Publication 17, Your Federal Income Tax on the IRS website. It’s a comprehensive collection of information for taxpayers highlighting everything you’ll need to know when filing your return.

- Review! Review! Review! Don’t rush. We all make mistakes when we rush. Mistakes will slow down the processing of your return. Be sure to double-check all the Social Security Numbers and math calculations on your return as these are the most common errors made by taxpayers.

- Don’t panic! If you run into a problem, remember the IRS is here to help.

More From Retro 102.5

![The Voice is Great! [VIDEO]](http://townsquare.media/site/49/files/2012/02/136526476.jpg?w=980&q=75)

![Paul’s Video of the Day – Samsung Commercial [VIDEO]](http://townsquare.media/site/49/files/2012/02/Samsung_Commercial.png?w=980&q=75)

![‘Are you Kidding Me?’ iPad for Cats ? [AUDIO]](http://townsquare.media/site/49/files/2012/02/Cat.jpg?w=980&q=75)

![The Voice Returns to NBC [VIDEOS]](http://townsquare.media/site/49/files/2012/02/Christina-The-Voice.jpg?w=980&q=75)